Securitization Pros and Cons

Securitization is a financial process that takes an asset of some kind and turns it into a security, which is a tradable financial asset. The assets that provide the basis for securitization are fundamentally those that generate receivables, essentially debt owed to a company by its debtors and customers. Receivables comprise capital and periodic interest. Assets generally used for securitization include loans (student loans, car loans, credit card loans etc.) and mortgages.

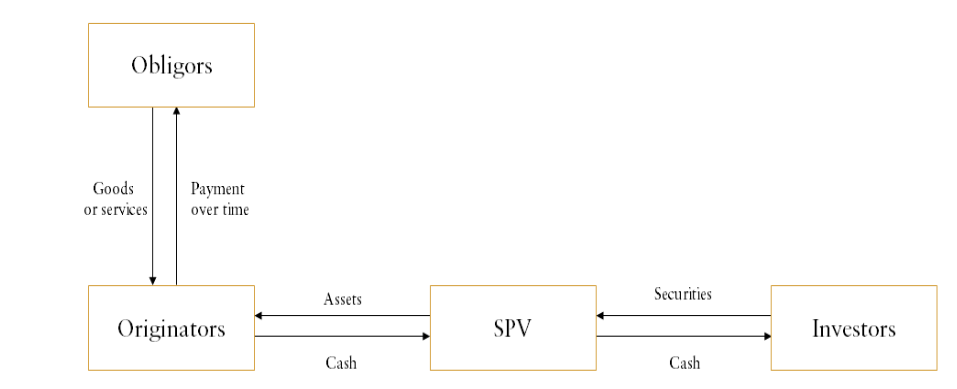

When a company decides to securitize such assets, it takes the debt that it is owed and puts it into a different entity, usually a trust or a special purpose vehicle (SPV) that it then sells on to another investor or group of investors called the master owner. The originating company receives payment for transferring this debt to the master owner and is now out of the transaction.

The SPV now in the hands of the master owner contains a large number of assets of some type or other that all generate receivables, and therefore income. These assets are divided into layers of securities or bonds called tranches. Each tranche comes with a risk rating, from the lowest risk rating of AAA to increasingly higher risk, until the riskiest tranche of all, which is the equity tranche.

These tranches are then sold to investors according to their risk appetite. Since the SPV comprises assets that generate periodic income, holders of these tranches have a claim to the income generated by the assets on which their securities are based. However, the lower the risk rating of a tranche, the lower the income it generates, but its owner is the first to receive payment. The higher the risk rating of a tranche, the higher the income it generates, but the further down the line its owner has to wait to receive income on his investment. This becomes a factor when, in a poor economy, the assets contained by an SPV are not all generating the income that they should be generating. Of course, an investor does not have to keep the securities in which he has invested. He can also sell these securities on their particular markets.

The Advantages of Securitization

Perhaps the greatest advantage of securitization is that it creates liquidity in the marketplace for the assets being securitized. This helps a company with debt on its books remove that debt from its balance sheet and acquire new funding in place of that debt. This is done by transforming that debt into securities through the process described above. As a result, the company would have received liquid funds in exchange for the debt that it has moved into securities. Even more attractively, removing that debt of its balance sheets may help to raise that company’s credit rating, thus allowing it to raise funds more cheaply than if that debt had remained on its balance sheets. However, transforming that debt into securities need not mean removing the account associated with that debt. Hence, these companies remove the risk of the debt, turn it liquid, but still earn income through the maintenance of that account.

Another advantage is that these debts can be layered into different tranches with different risks. These offer great choice to investors as through these tranches investors have access to returns and risk that more closely match their appetites. For example an ultra-cautious investor may choose to invest in securities rated at AAA, meaning that they will be the first to receive a return on income, but with the lowest rate of that income. An investor that has a higher risk appetite may choose to invest in BBB securities, meaning that they will have to wait until the investors in higher rated securities have been paid off, but in return they will receive a higher rate of income of their securities.

Securitization also has advantages for borrowers. Given that securitization allows companies to efficiently use the debt on their books and make it liquid, while giving investors a range of attractive options for investment, securitization means that these debt assets are valuable and attractive. Hence, companies compete in offering loans to borrowers and this competition leads to all sorts of advantages for these borrowers, including more competitive rates, cheaper financing, more choice and quicker processing times. Essentially, with securitization, companies compete for the custom of borrowers, whose loans they can transform into securities to enjoy the benefits outlined above.

Disadvantages and Risks

Securitization is an exceptionally clever process that has very significant benefits for practically everyone involved. It takes debt off a balance sheet and replaces it with liquidity. It provides third-party investors with clearly rated investments that pay according to the risk that they are willing to shoulder. And it leads to greater choice and competitive rates for borrowers, whose loans are now treated as far more of an asset than as a liability. However, the complications of the process can lead to opacity that can severely raise the risk to investors in the securities themselves. Nonetheless, with proper oversight and expertise, these risks can be so carefully managed that they are reduced to the absolute minimum.

For more information on how Zeta can assist you please contact our Business Development department on bd@zeta-financial.com.