Revised Malta Permanent Residence Programme (MPRP): Key Updates Effective January 2025

Introduction

The Malta Permanent Residence Programme was introduced in 2021, granting beneficiaries the right to reside, settle or stay in Malta indefinitely, provided her adheres to all obligations and conditions.

For further information on the current framework, kindly refer to our article here.

On the 19th of November 2024, the Malta Permanent Residence Programme (Amendment No. 2) Regulations 2024 were published in the Government Gazette, introducing a number of changes to the current regulatory framework which are to come into force as from 1st January 2025.

Narrower Definition of Dependent

Currently, eligible dependents include:

(a) The spouse;

(b) A child of the applicant/spouse under 18-years-old;

(c) A child of the applicant/spouse over 18-years-old who is not married and is principally dependent on the main applicant;

(d) A parent/grandparent of the applicant/spouse who is principally dependent on the main applicant;

(e) An adult child of the applicant/spouse who is certified as having a disability.

As from 1st January 2025, eligible dependents will include:

(a) The spouse;

(b) A child of the applicant/spouse under 18-years-old;

(c) A child of the applicant/spouse who is above 18 but younger than 29-years-old, is not married at the time of the application and is principally dependent on the main applicant ;

(d) A parent/grandparent of the applicant/spouse who is principally dependent on the main applicant;

(e) An adult child of the applicant/spouse who is certified as having a disability.

Increase in Price of Qualifying Owned Property

Currently, the qualifying owned property must be (a) a property of not less than €350,000 in Malta or (b) a property of not less than €300,000 in South of Malta or Gozo.

As from 1st January 2025, the distinction between properties situated in Malta and South of Malta or Gozo will be removed. Furthermore, the minimum purchase price to qualify as qualifying owned property will increase to €375,000.

Increase in Price of Qualifying Rented Property

Currently, the qualifying rented property must be leased at (a) at least €12,000 per annum in Malta; or (b) at least €10,000 per annum in South of Malta or Gozo.

As from 1st January 2025, the distinction between properties situation in Malta and South of Malta or Gozo will be removed, with the minimum lease to qualify becoming €14,000 per annum.

Alternative Criteria as Evidence of Possession of Assets

Currently, an applicant must provide evidence of possession of assets of not less than €500,000, of which €150,000 must be financial assets.

As from 1st January 2025, an applicant has a choice to provide proof of:

(a) Possession of assets of not less than €500,000, of which €150,000 must be financial assets; or

(b) Possession of assets of not less than €650,000, of which €75,000 must be financial assets.

Increase in Non-Refundable Administration Fee

Main Applicant’s Administration Fee

The non-refundable Administration Fee is set to increase from €40,000 to €50,000 as from 1st January 2025.

The first settlement due upon submission of the application will increase from €10,000 to €15,000 as from 1st January 2025. The remaining €35,000 must be paid within 2 months from the date of issue of the Letter of Approval in Principle.

Dependent’s Administration Fee

Currently, no further administration fee is required for dependents to be included in the main applicant’s certificate when applying for a certificate.

This is set to change as from 1st January 2025, with a non-refundable administration fee of €5,000 becoming due for each and every dependent upon the issuance of the Letter of Approval in Principle. However, dependents certified as having a disability will not be subject to the payment of any non-refundable administration fee.

Increase in Government Contribution

Main Applicant’s Contribution

Currently, the main applicant must pay a contribution of:

(a) €28,000 when the Qualifying Property is s Qualifying Owned Property; or

(b) €58,000 when the Qualifying Property is a Qualifying Rented Property.

As from 1st January 2025, these will increase to

(a) €30,000 when the Qualifying Property is a Qualifying Owned Property or;

(b) €60,000 when the Qualifying Property is a Qualifying Rented Property.

Dependent’s Contribution

Currently, an additional contribution of €7,500 for each and every parent/grandparent dependent included in the application becomes due upon issuance of the Letter of Approval in Principle.

As from 1st January 2025, the additional contribution will decrease to €5,000 but its scope will be broadened, becoming due in respect of each and every dependent included in the application. However, dependents certified as having a disability will not be subject to the payment of any contribution.

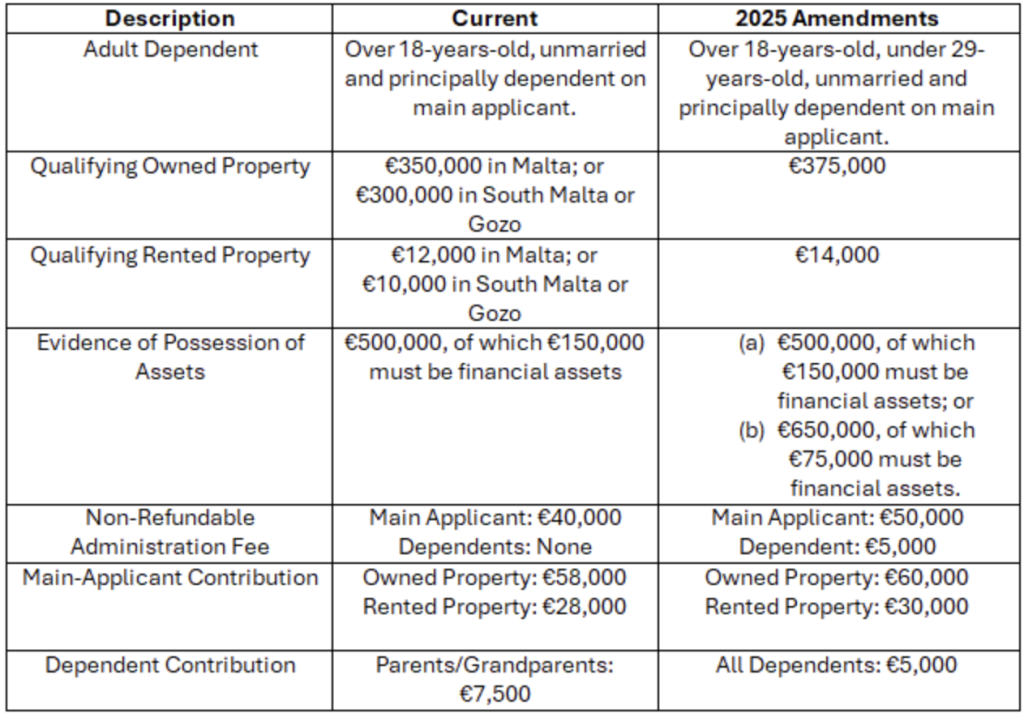

Summary of Changes