Crypto Funds in Malta

Why Malta?

Malta has positioned itself as a dependable and adaptable EU financial services and Fintech hub. An array of structures such as Professional Investor Funds (PIFs), Alternative Investor Funds (AIFs) and UCITS cater for the needs of both traditional and more innovative sectors of the market.

The Malta Financial Services Authority (MFSA) authorizes and issue licenses to investment funds, in agreement with the established schemes and arrangements for Maltese funds. Currently, the only fund structure that allows investments in Virtual Financial Assets is PIFs.

Legal Aspect

The legislation governing PIFs in Malta is the Investment Services Act, (ISA). The ISA establishes the regulatory framework for investment services providers and for Collective Investment Schemes. A PIF license is issued from the MFSA when the PIF fully meets the requirements relating to its purpose. PIFs investing in cryptocurrencies are required to submit additional application documents in line with the MFSA’s Investment Services Rules for Qualifying Professional Investor Funds.

PIFs investing in cryptocurrency can invest directly, or indirectly through a trading company/Special Purpose Vehicle. Such PIFs may also be self-managed, subject to the Portfolio Manager having sufficient knowledge and experience in the field of information technology, Virtual Currencies and their underlying technologies. PIFs investing in cryptocurrency can only be established either as:

- Investment Companies;

- Limited Partnerships; and,

- Unit Trusts.

Requirements

A PIF is required to obtain a license by the MFSA. PIFs investing in cryptocurrencies will need to follow a number of supplementary license conditions.

Competence

The participants are required to provide sufficient knowledge and expertise in the field of information technology, Virtual Currencies and their underlying technologies, including but not limited to DLT.

Directors

A PIF will require a minimum of three directors one of which is to be situated in Malta. The director based in Malta may also choose to act as the PIF’s compliance and money laundering reporting officer.

Investors

A VC Fund can only approach professional investors (as defined by MiFID). They must invest solely in virtual currencies (directly or indirectly) and investors have to invest a minimum of €100k or its equivalent currency in the PIF. A PIF requires a minimum two investors who may be individuals or body corporates.

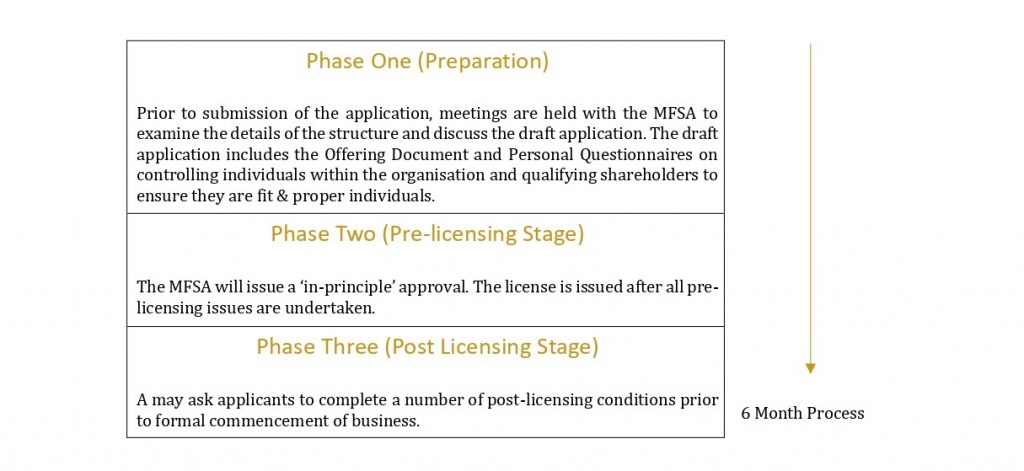

PIF Licensing

For more information on how Zeta can assist you please contact our Business Development department on bd@zeta-financial.com.