Malta Professional Investment Funds (PIFs)

Investment Funds in Malta

Malta has maintained steady growth as a domicile for licensed collective investment schemes throughout the continuing global financial crisis. Rates of growth are projected to increase further going forward as Malta seeks to position itself amongst the foremost investment fund jurisdictions.

Investment funds may be established domestically as UCITS, retail or non-retail Alternative Investment Funds AIFs), professional investor funds (“PIFs”) or Private Collective Investment Schemes.

A retail fund may be set up as a UCITS or a retail AIF. Such retail funds are, of course, promoted to the general public and are, accordingly, highly regulated and subject to rigorous investment and leverage restrictions. A non-retail private collective investment scheme would, by definition, be private in nature having no more than 15 close friends and/or relatives as participants in the fund – although a company may participate as an investor provided that, having regard to its beneficial owners, the same are close friends and/relatives and, at any rate, would not exceed fifteen in number.

Qualifying Investors

In turn, the domestic regulatory regime caters for the establishment of PIFs targeting “Qualifying investors”. Qualifying investors would be required to show that they have the requisite knowledge and experience to make their own investment decisions and to understand the risks involved.

The overwhelming majority of investment funds established in Malta to date have been licensed as PIFs and typically in the form of open-ended public or private limited liability investment companies with variable share capital (‘SICAVs’). Such PIFs may also be constituted as “multi-class funds”, “umbrella fund” or as incorporated cells of recognised incorporated cell companies. However, an investment fund may alternatively be set up domestically:

- As a closed- ended public limited liability investment company with fixed share capital (“INVCO”); or

- In the form of a limited partnership; or

- Mutual fund; or

- Unit trust or foundation.

PIFs, being non-retail funds, generally enjoy a regulatory “fast track” and a reduced level of ongoing regulation and supervision. In addition, PIFs are not subject to any prescribed restrictions on investment or borrowing. These features of a PIF, together with an attractive fiscal environment, conspire to make Malta an increasingly popular hedge fund domicile.

PIFs Promoted to Qualifying Investors

Investors qualifying as such must satisfy the following prescribed eligibility criteria:

- Invests a minimum of €100,000 or its currency equivalent in the PIF which investment may not be reduced below this minimum amount at any time by way of a partial redemption; and

- Declares in writing to the fund manager and the PIF that it is aware of and accepts the risks associated with the proposed investment; and

- Satisfies at least one of the following:

- A body corporate which has net assets in excess of €750,000 or which is part of a group which has net assets in excess of €750,000 or, in each case, the currency equivalent thereof;

- An unincorporated body of persons or association which has net assets in excess of €750,000 or the currency equivalent;

- A trust where the net value of the trust’s assets is in excess of €750,000 or the currency equivalent;

- An individual whose net worth or joint net worth with that of the person’s spouse, exceeds €750,000 or the currency equivalent; or

- A senior employee or director of a service provider to the PIF.

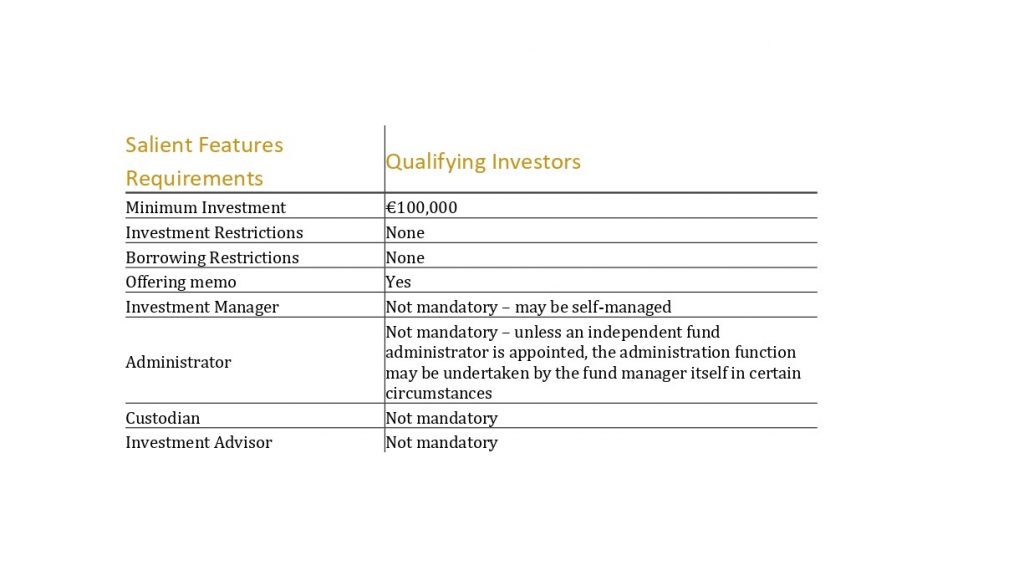

PIFs promoted to Qualifying Investors would have the following key features:

- Minimum permitted investment of €100,000 or the equivalent in any other currency;

- Generally, no specific investment restrictions apply other than those outlined in the fund’s Offering Document;

- Generally, no borrowing or leverage restrictions other than those outlined in the fund’s Offering Document;

- Generally, no mandatory appointment of any investment fund service providers, save for the appointment/constitution of a suitable management and fund administration function;

- Issuance of an Offering Document.

Features and Requirements for the PIF

Service Providers and Management

Whilst PIFs are not generally required to engage third party services providers (PIFs may, in fact, be self-managed), any service provider appointed by a PIF must be approved by the MFSA. Service providers not established in an EU/EEA Member State, may be accepted by the MFSA – typically should the MFSA be satisfied that the same are regulated adequately.

Licensing

The MFSA would grant an investment fund licence if it is satisfied that the relevant fund will comply in all respects with the requirements of Maltese law, the relevant rules and regulations prescribed thereunder, and that the fund, its directors, officers and service providers are fit and proper persons to carry out the functions required of them in connection with the fund.

The application process typically involves the following three phases:

- Preparatory Phase – generally involving preliminary meetings and correspondence with the MFSA, preparation and compilation of the applicable licence application and supporting documentation and the review thereof by MFSA.

- Pre-Licensing Phase – generally involving the execution of all submitted documentation and the finalisation of any outstanding matters and the issuance, by the MFSA, of its “in principle” approval for issuance of a Licence.

- Post-Licensing Phase – generally involving, as applicable, the completion of post- licensing matters prior to formal.

What Makes Malta an Attractive Location to Set Up a PIF?

Malta strives to balance the interests of operators and consumers by providing a pro- business regulatory environment but which is secure and robust and intolerant of abusive practices.

In addition, no tax is payable in Malta on income or gains, other than income or gains from immovable property situated in Malta, derived by a Malta licensed investment fund (thus including PIFs) provided that more than 15% of the fund’s assets are situated outside Malta. In turn, no Malta tax would be levied or withheld on dividends distributed by an investment fund in favour of non-resident members/unit holders.

No Malta tax would be chargeable on gains realised by a non-resident on a disposal of any units in an investment fund, albeit provided that the non-resident is the beneficial owner of the relevant gains and is not owned and controlled by, directly or indirectly, nor acts on behalf of an individual or individuals who are ordinarily resident and domiciled in Malta. An investment fund established in Malta should also be entitled to access Malta’s extensive tax treaty network.

For more information on how Zeta can assist you please contact our Business Development department on bd@zeta-financial.com.